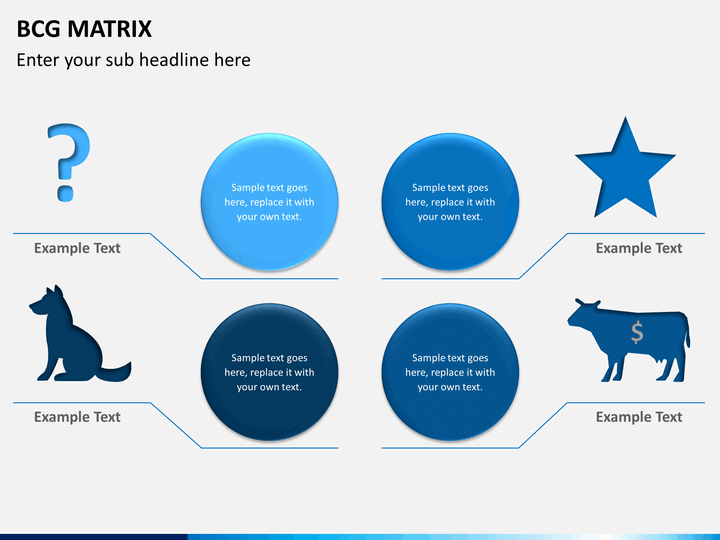

The BCG matrix is broken up into 4 quadrants:ĭogs or “Pets” are products that have a low market outlook and low market share. These are expressed in the matrix as relative market share, and market growth rate. The matrix does so on the basis of two main factors – market attractiveness, and company competitiveness.

Its aim was to help companies decide which markets and products were most worthy of investment. The matrix was first published in one of the Group’s essays titled Perspectives. The Boston Consulting Group Growth Share Matrix was introduced in 1968 by Bruce Henderson, the Group’s founder. Today, the BCG Growth Matrix still holds value and can offer a unique view of your business’ digital marketing strategy. These random-sounding animals and objects were the key to the success of some of the largest conglomerates and companies in the 1970s and 80s. The Boston Consulting Group’s Growth Share Matrix (BCG-GSM) was once used by half of the Fortune 500 list. Odds are you’ve come across it even if you haven’t. A cow, a dog, a star, and a question mark walk into a bar… Sound familiar? If it does, then there’s a good chance you studied strategic management in academia at some point.

0 kommentar(er)

0 kommentar(er)